SAT GOB MX CITAS FULL

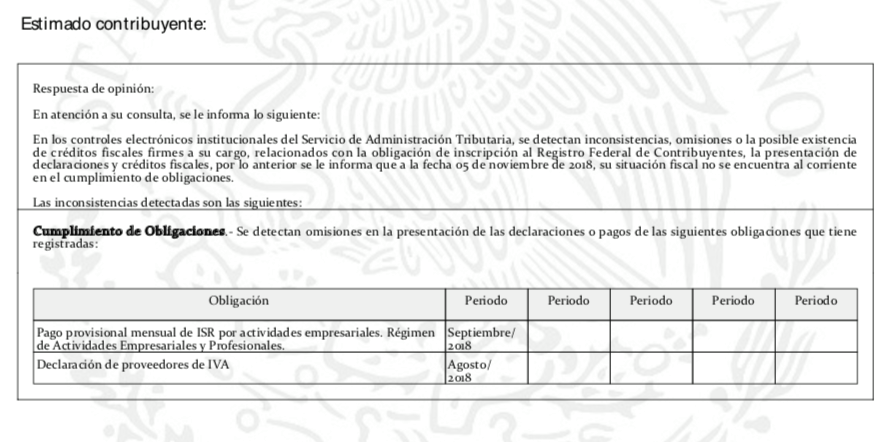

You need a document whose full title is Constancia de Situación Fiscal. Note that the Spanish word «Constancia» simply means “proof” in Spanish and there are other documents with the word «Constancia» on them. If you actually can make an appointment, take it because it may go away in a few seconds as thousands of people are trying to get them.įor the Constancia de Situación Fisca l, you can complete the process online, but you must have a RFC number first to fill out the Constancia de Situación Fiscal. You will get an email confirming that you are in the virtual line and to monitor your email for your date. If so, enter your email address to be put into a “virtual line” for the next available appointment. If you don’t speak Spanish, use Google Translate to convert it to English or have a bi-lingual friend help you.įill in your info, follow the steps which will bring you to a calendar to use to schedule an appointment, but you will likely see a notice telling you there are no appointments available. Follow the steps on the site for a personal RFC (not a business RFC). You will need your CURP number (if you don’t know your CURP number, see below). Lázaro Cárdenas 2305, Las Torres, Guadalajara 44920.įor an RFC, you must get an appointment, which you can do online at. The nearest SAT office to Lakeside is in Guadalajara at Calz. You must go in person, with your documents, so they can obtain your biometric information.

You get an RFC number by physically showing up at an office of the Mexican equivalent of the American IRS, called the Sistema de Administración Tributaria (English: Tax Administration System), known by its initials, SAT. The process for the Constancia de Situación Fiscal is much simpler and is done completely online, although you can hire someone to help you with it, too.You will need your RFC before filling out the Constancia de Situación Fiscal form. But at some point you will have to personally visit a Mexican tax office so they can obtain biometric information of physiological characteristics like – but not limited to – fingerprints, iris patterns, or facial features. The process is complicated, although you can hire someone to help you.

If you don’t have an RFC, you have to actively go through a process to get one. Some people who have been here awhile may have been assigned an RFC number, so you should go online and check if you have one (see video link in the box).

If you have a Temporal, a Permanente or a CURP, you must get an RFC number. who lives in México, full time or part time, whether or not you earn money in México. This is a NEW REQUIREMENT FOR EVERYONE over the age of 18. Without an RFC number you won’t be able to open a bank account, and in some places, sign up for an internet service. Without an RFC number on your CFE bill, you won’t be able to sell your house or buy a car. The RFC number and the Constancia de Situación Fiscal will be used by the Mexican government to track income and potential money laundering, but they will be used for many other things. Plus, if you do business in México– even if you are only a customer of CFE or the water company or an internet provider – you need to fill out a form Constancia de Situación Fiscal (English: Proof of Fiscal/Tax Situation), which companies will soon be asking you for, if they have not already. The 2022 Tax Reform law passed by México now requires all citizens and legal residents (Permanente or Temporal) to have a Registro Federal de Contribuyentes (English: Federal taxpayer registration), known simply as an RFC number. Do you have RFC number? Do you know if you do? Do you know what it is and that you need one? If the answer was no to any of there questions, read on. Patrick O’Heffernan and Catherine-Claire Blythe.

0 kommentar(er)

0 kommentar(er)